Reduce Online Fraud With Cardknox’s Support For EMV® 3-D Secure

Start Authenticating Your Transactions

Cardknox’s online payment solutions feature powerful 3DS2 technology that protect merchants from fraud and boost sales. Tap into the Cardknox API to build a full gateway integration, or use our hosted checkout form, PaymentSITE, that can be embedded in an online checkout flow or used as a standalone form.

Reduce fraud and chargebacks

Improve conversions

Eliminate friction at checkout

Cardknox is proud to support all four of the major card brands’ exclusive 3DS2 solutions:

What is 3-D Secure?

Introducing EMV® 3-D Secure 2.0

In recent years, EMVco—a global organization that oversees payment security—realized that there was a need for a next-generation 3-D Secure solution that would take into account the latest industry technologies and standards. As a result, EMVco launched its EMV® 3-D Secure solution, or EMV 3DS, in 2016. Previously known as 3-D Secure 2.0, this powerful technology incorporates the latest industry advancements and it’s on track to becoming a global standard for e-commerce payment security.

EMV® 3-D 2.0 Secure Improvements

Robust Risk-Based Authentication

EMV® 3-D Secure utilizes additional customer- and transaction-specific data points, such as the consumer’s email address, name, or phone number to authenticate a greater number of transactions in less time and without the cardholder’s involvement.

Removes Friction & Speeds Up Checkout

EMV® 3-D Secure’s robust data exchange reduces the odds that the customer will need to take the time to verify their identity. In the event that customer verification is needed, EMV® 3-D Secure offers even more customer-friendly authentication methods, and it enables merchants to embed the authentication process into their payment flow (rather than redirecting the cardholder to the issuing bank’s website).

EMV® 3-D 2.0 Secure Improvements

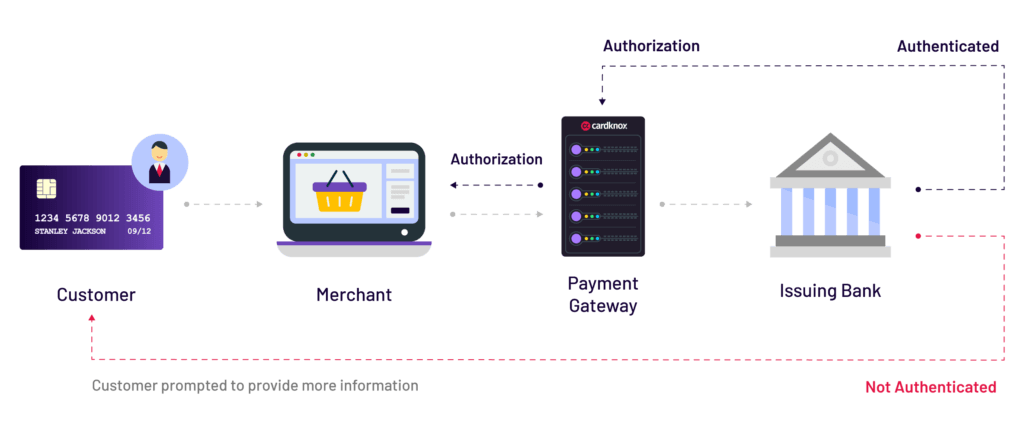

- The customer initiates a transaction online.

- The Cardknox payment gateway passes key data points on to the cardholder’s issuing bank so that they can evaluate risk.

- If the issuing bank successfully authenticates the customer’s identity and decides that the transaction poses a low fraud risk, then the transaction is authorized. This is the case with the majority of 3-D Secure transactions. Note: when this occurs, the merchant is not held liable if the transaction turns out to be fraudulent; the issuer would be liable instead.

- If the issuing bank was unable to authenticate the cardholder’s identity per the above steps, the cardholder will be prompted to provide more information. The issuing bank will then choose whether or not to authenticate the transaction.