Cardknox Merchant Portal January 2021 Release Notes

We’re pleased to bring you the first software release of 2021 for the Merchant Portal. As part of our effort to continuously improve the portal, you can now:

Bulk charge customers on the Customers screen

Add a business logo to your PaymentSITE form

Send a test email for the Send Payment Request email template

Receive email alerts when a transaction reaches the maximum number of retries

View a terminal’s serial number for an in-person POS transaction

Specify a three-digit number when specifying the number of recurring transactions

As has been the process for a couple of months now, you can see these changes in the Beta Portal. For more information or to learn how to access the Beta Portal, see this section of the Cardknox Merchant Portal User Guide.

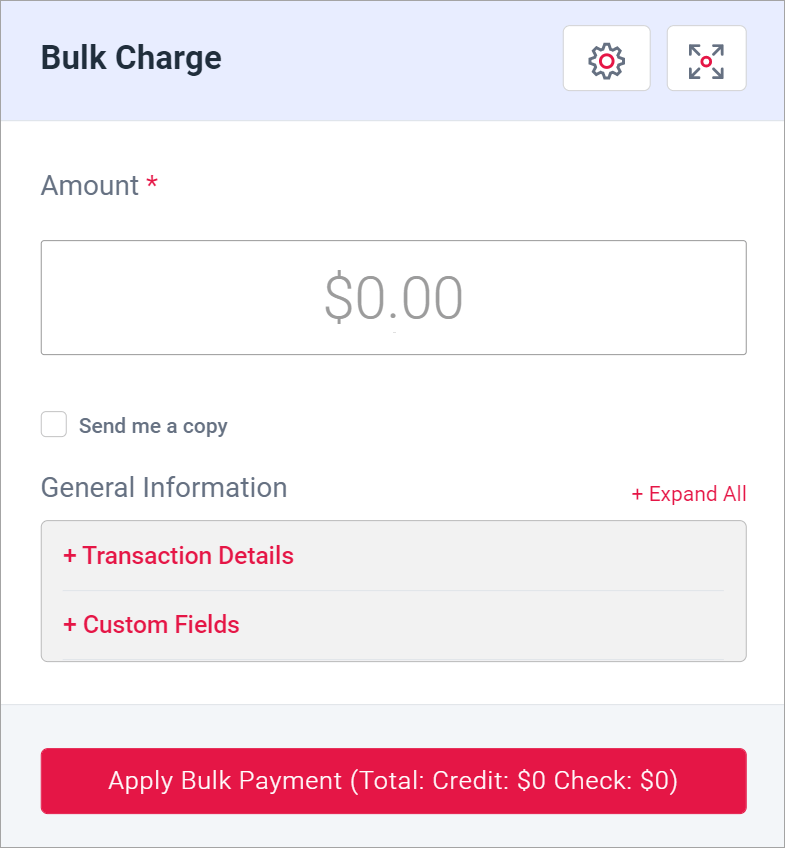

Bulk Charge Customers

You can now process multiple charge transactions across several customers at the same time. Currently, to use this new feature, you must charge all customers the same amount. (We hope to support the ability to charge different amounts in a future release.)

To access this new feature, on the Customers screen, select the checkbox for one or more customers. Click the + icon to the right of the Filter button. For more details, see the “Bulk Charge Customers” section in the Cardknox Merchant Portal User Guide.

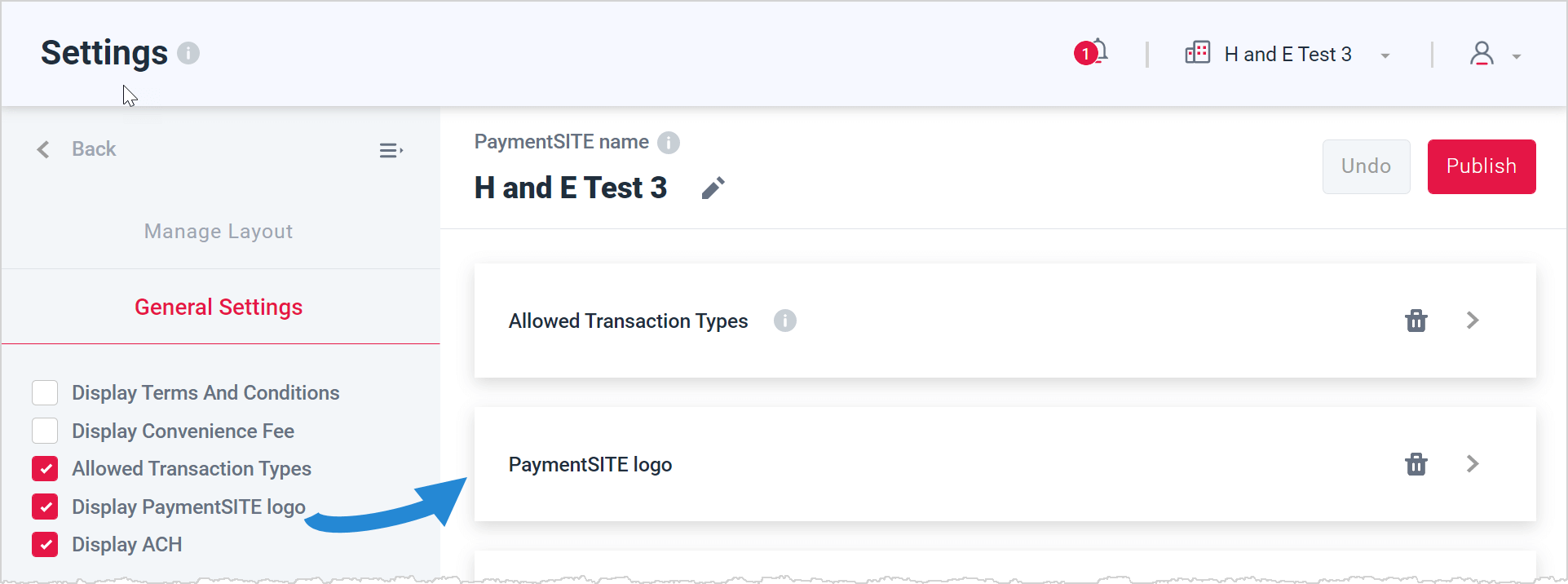

Add a Business Logo to Your PaymentSITE Form

Last month we added the ability to include your business logo on emailed customer receipts, within the Portal, and on request for payment emails. For this release, you can now also include the logo on your PaymentSITE form.

To include your logo on a PaymentSITE form, select Settings → PaymentSITE. Click on the General Settings tab and check the Display PaymentSITE logo box.

To the right, you’ll see the newly added PaymentSITE logo section. From there, you can upload the logo graphic file. When you publish the form, the system displays the logo centered at the top of the form.

Send a Test Email for the Send Payment Request Email Template

After setting up the email template that gets sent to customers when you use the Send Payment Request feature, you can now send a test email to co-workers or yourself.

To access this new feature, go to Settings > Send Payment Request and click the Send Test Email button.

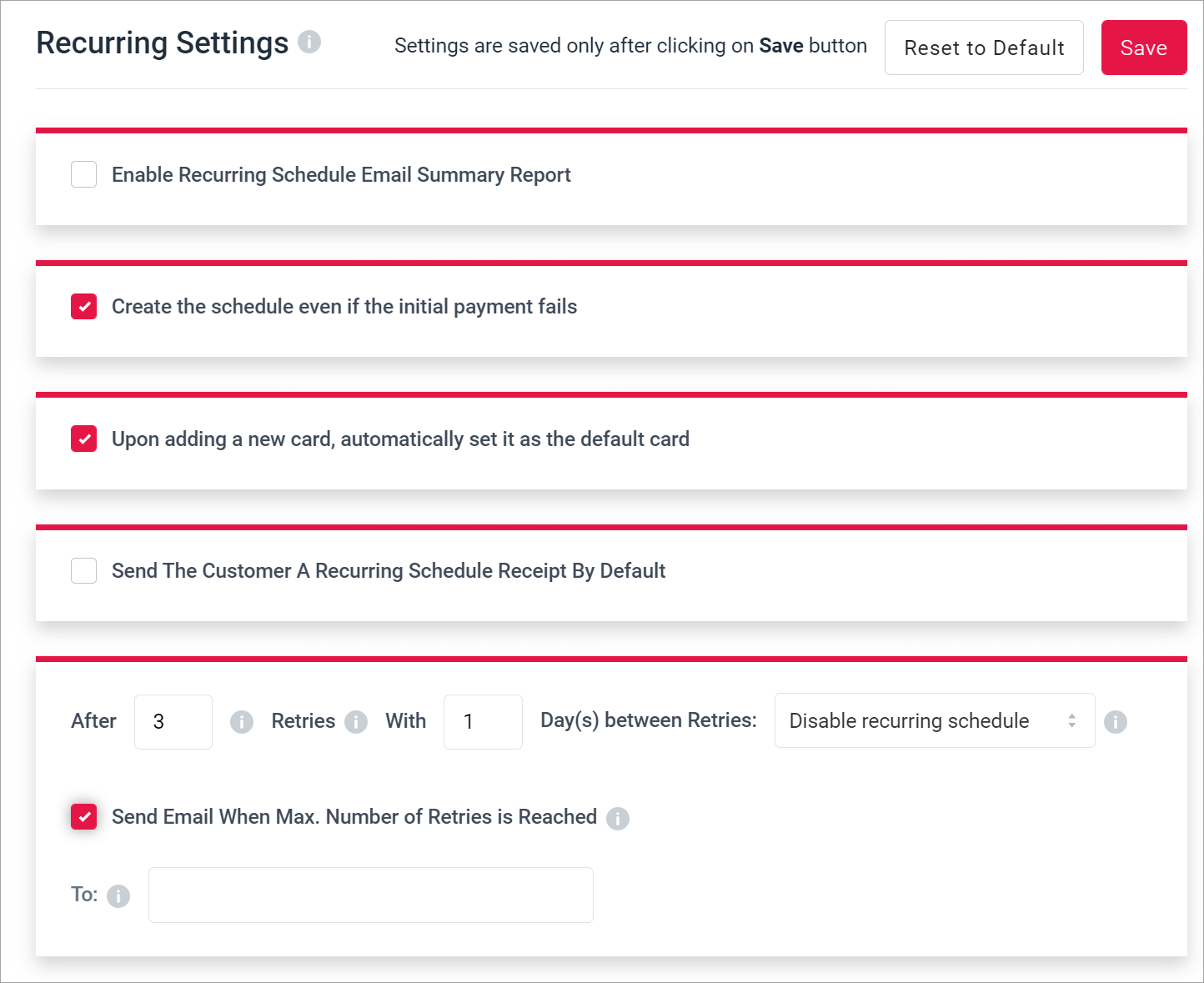

Receive Email Alerts When a Transaction Reaches the Maximum Number of Retries

You can now have an email alert sent to let you know when a transaction has reached its maximum number of retries. Along with the Expired Payment Methods report (covered in the December Release Notes), this will keep you informed of problematic transactions.

To use this new setting, go to Settings > Recurring. The setting is the Send Email When Max. Number of Retries is Reached checkbox. Select the checkbox an in the To field specify which email address(es) will receive alerts.

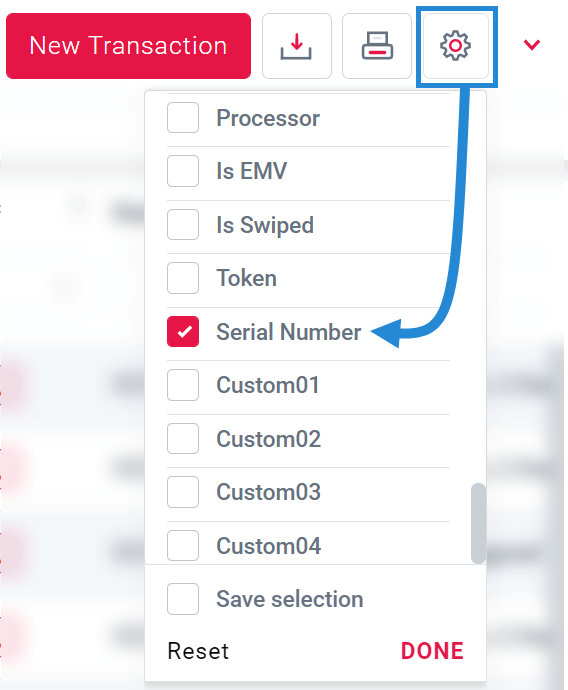

View a Terminal’s Serial Number for an In-Person POS Transaction

For merchants who need to see a terminal’s serial number (associated with in-person point-of-sale transactions), you can now add the Serial Number column to the Transactions screen (including transaction reports).

To see this column, on the Transactions screen, click the gear icon, then check the Serial Number box:

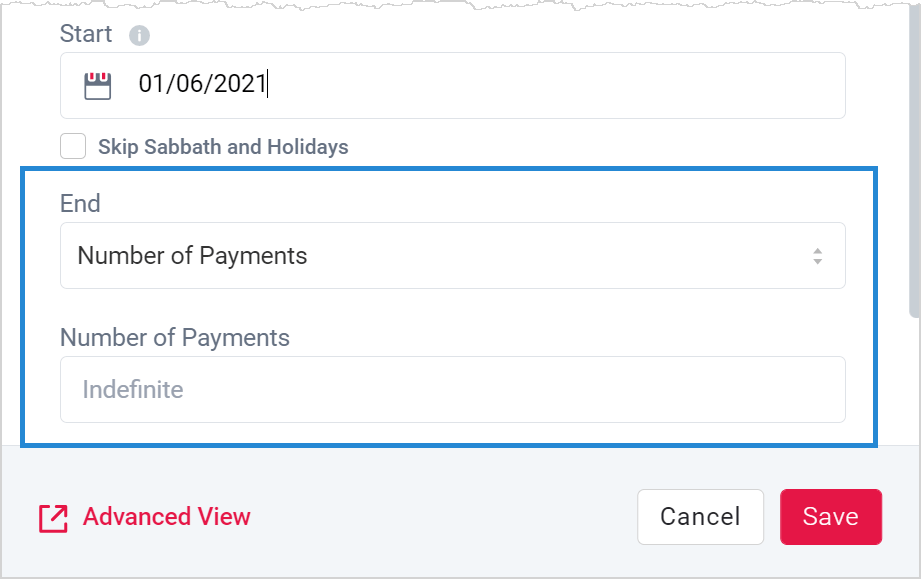

Specify a Three-Digit Number When Specifying the Number of Recurring Transactions

It’s now possible to specify a three-digit amount in the Number of Payments field when setting up a recurring schedule (an ability that some merchants requested).

To try this out, go to Recurring Schedules and click the New Customer button. Scroll down, click on the End field, and select Number of Payments from the dropdown. Type the number of payments in the text box that displays below the dropdown:

How to Try Out These New Features

Currently, these new features are available in the Beta Portal. It’s easy to enter the Beta Portal and return to the regular Merchant Portal. To enter, click on the user icon in the upper left corner and select Enter Beta Portal:

To leave the Beta Portal, repeat the step above, but select Leave Beta Portal.

Like the Changes? Or Not a Fan?

We invite you to try out the new features and let us know how they work for you. Your feedback is very important to us! Take a few moments to fill out the feedback form, and help us make the Cardknox Merchant Portal the best possible experience.

We hope the beginning of the new year has been positive and prosperous for you and yours!

Thank you for choosing Cardknox!