Cardknox Portal April 2020 Release Notes

Our latest updates in the Cardknox Merchant Portal will make it that much easier to view all of your most important payment data at-a-glance. From recurring schedule daily reports, to revamped customer and recurring data viewing, to customer gift card balances, we’ve made enhancements to several modules in the Portal so that you can stay up to date with your payment activity in less time.

Manage Your Recurring Payments the Way You Want

We’ve added a new Recurring Settings tab in the Settings Module so that you can customize your recurring payments capabilities:

- Opt-in for Daily Emailed Recurring Summary Reports

Check the box next to ‘Email Recurring Daily Summary Report’ to start receiving daily notifications with all your recurring payment activity. - Confirm That a Schedule Can be Set, Even if the First Payment Fails

To ensure that recurring schedules are successfully created even if the initial payment is declined, check the box next to ‘Create the Schedule Even if the Initial Payment Fails.’ - Choose the Next Step for Recurring Payments That Hit Max Retries

Click the dropdown menu to choose whether you’d like schedules to be disabled in the event that all attempts have failed, or, if you’d like the schedule to be resumed on the next scheduled date.

Improved Data Display

- Upgraded Recurring and Customers Expanded View

Upon selecting a specific customer or recurring schedule in its appropriate module, the expanded view will display on the right-hand side of the page. This expanded display takes up a larger portion of your screen without eclipsing other important data, providing a much more user-friendly experience. Once you’re in expanded view, you can easily toggle through the navigation bar at the top of the expanded view window to see the selected customer/recurring schedule’s associated payment methods, general info, transaction history, and more. - New Icons to Quickly Create a Schedule, Send a Payment Request Form, & More

While browsing through your customers or recurring schedules, you can now manage data and process payments with just the click of a button! We’ve added icons to the right of your recurring

schedules and customers in each associated module, enabling you to carry out important tasks that much faster:- Delete the customer/recurring schedule

- Process a new transaction

- Send a payment request

- View Additional Details for Cardknox Go Transactions

If you accept payments through our Cardknox Go flat-rate model, you’ll now be able to access even more details on those transactions! Simply navigate to the Transaction Settings tab of the Settings module to enable the following features for Cardknox Go payment data:- Disputes Module

Keep tabs on your customer disputes so you can respond even faster. Simply check the box next to Show ‘Disputes’ Module, and the Disputes module will be added to the main navigation bar. Upon navigating to this tab, you’ll see a list of any disputed Cardknox Go transactions with relevant details for each. - See Split Payments for Your Transactions

You can now view the breakdown of split payments, including the net balance of how much gets funded to your account. To do so, check the box next to ‘Include Split Pay Transactions,’ and your split payment information will be added to the General Information section of transaction details.

- Disputes Module

- Upgraded Recurring and Customers Expanded View

Revamped Gift Report Module

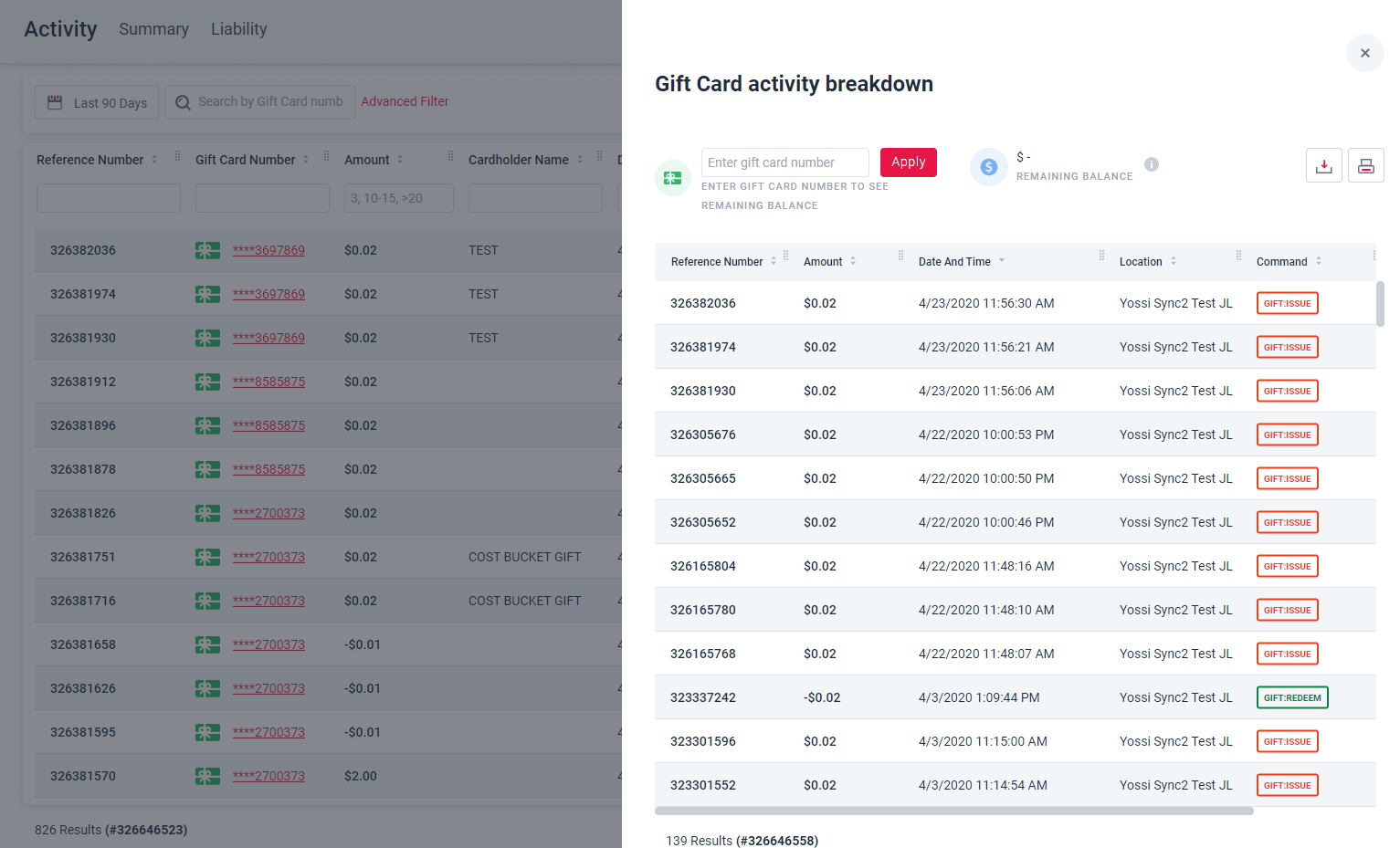

We’ve upgraded the Gift Report module to enable you to easily locate gift card information, export and print reports, and more.

- Improved Design

The Gift Report navigation bar is now even bolder and more intuitive. And, the Activity tab of the Gift Report module now displays by default, giving you a glimpse of all recent gift card transactions right away. - Search by Gift Card Number

We’ve added a search bar to the top of the Gift Report Module where you can input a gift card number to locate information on that gift card’s activity. - View a Breakdown of Card Activity

Upon selecting a specific gift card in your report, an expanded view window will open up on the right-hand side of the screen. You’ll be able to see an overview of all associated transaction amounts, dates, locations, and more. - Export and Print Your Gift Report

Keep your payment data at your fingertips—you can now download and print your gift card report!

Print Your Transactions Report

Upon clicking the ‘Print’ icon in the Transactions tab, you can now choose to print the data that’s currently displayed, rather than the full transactions report!

Even More Enhancements

- Improved speed in the Recurring Schedules and Customers modules

- Filter transactions by debit in the Payment Method column of the Transactions tab

- View the grand total in your transaction report

- Opt to View Your Open Batches on the Batches Module’s Dashboard by Default