What Is a Payment Facilitator?

As payment technology advances, software-as-a-service (SaaS) professionals, independent software vendors (ISVs), value- added resellers (VARs), and developers are taking advantage of the opportunity to insource payment processing using the payment facilitator (PayFac) model. By owning the technology that supports payment processing, SaaS businesses stand to gain a variety of benefits—with the opportunity to generate an additional revenue stream leading as number one. ISVs and SaaS businesses that become PayFacs can multiply revenues up to fourteen times. With this in mind, it’s no wonder that the PayFac model is skyrocketing in popularity.

Read the full white paper anytime and anywhere.

In addition to a lucrative revenue opportunity, PayFacs also benefit from the ability to take control of payment processes, allowing them to deliver a seamless end-to-end user experience. As a result, onboarding is typically faster than other payment processing models, and the overall user experience is improved.

Becoming a PayFac is an expensive endeavor, however. Businesses that want to pursue this model must make large capital investments in the infrastructure, processes, and staff required to get started and maintain operations. PayFacs also carry the increased risk that comes with payment processing, including chargebacks, fraud, and merchant insolvency.

Is the PayFac model right for your business? This white paper will explain this popular model, how it works, its benefits, and various options for becoming a PayFac so that ISV and SaaS businesses can make an informed decision.

How Do PayFacs Work?

The Traditional Merchant Onboarding Process vs. the PayFac Model

To fully understand the benefits of the payment facilitator model, it’s important to first take a look at what goes into creating a standard payment processing agreement. In a traditional onboarding process with an Independent Sales Organization (ISO), the merchant must first sign a direct agreement with a processing bank. The merchant interacts directly with the ISO and follows their set processes to register and become approved to accept payments. This enrollment and onboarding process often entails a great deal of paperwork and can take days or even weeks to complete. During this time, the merchant is thoroughly vetted through a Know Your Customer (KYC) program that verifies identity, ensures compliance with legal requirements, and assesses risk. In the meantime, the ISV or VAR is hoping that the merchant has a positive experience and does not experience any frustrations that could impact the relationship.

The PayFac Advantage

By contrast, the payment facilitator model eliminates the need for merchants to interface with the processor. Instead, merchants are onboarded and registered by the PayFac—bringing ISVs, SaaS businesses, and developers more control over their merchant’s onboarding and processing experience. To become a PayFac, the ISV or VAR signs a direct agreement with a processing bank (e.g., Elavon or Fiserv) to process payments on behalf of their merchant clients. Merchants can then tap into the payment facilitator’s existing relationships with acquiring banks and the PayFac’s processing technology to get up and running fast.

Merchant Relationship

| Traditional | In a traditional model, merchant clients follow the ISO’s onboarding processes in order to register to accept payments. |

| PayFac | By interacting directly with their clients, PayFacs enjoy more control of their customers’ onboarding and processing experience. |

Risk Management

| Traditional | Since the ISO underwrites merchants, they bear the burden of risk when it comes to fraud, chargebacks, and PCI compliance. |

| PayFac | Because the acquiring bank underwrites the payment facilitator instead of the merchant, the PayFac assumes liability for all financial risk on behalf of its merchants. |

Onboarding Processes

| Traditional | Merchants undergo a detailed analysis to verify the business’s identity, evaluate potential risk, and ensure the business maintains the necessary compliance requirements. This process can take days or weeks to complete. |

| PayFac | The payment facilitator undergoes the lengthy onboarding process—not the merchant. To become approved, the merchant provides a few key data points to the payment facilitator. The information is then evaluated by an underwriting tool, and the application is either approved or declined in real time. The whole process can be completed in minutes. |

Fee Structures

| Traditional | Traditional payment processing fees are generally charged using the interchange plus model. With this system, rates are variable since every processed transaction qualifies for a specific rate category. Rates change based on the type of business the merchant conducts, schedules and rules provided by the card brands, as well as a number of other factors. But even though rates do change, there is rate optimization technology that can work on the merchant’s behalf to reduce their costs. |

| PayFac | PayFac models have a simple and transparent flat-rate fee structure, without the variability of traditional payment models. Merchants benefit from predictable costs and easy budgeting. |

PayFacs By The Numbers

The payment facilitator model is experiencing rapid growth. Conservative projections estimate that by 2025, the number of PayFacs will have increased over 91% since 2020. Gross payment volume processed by PayFacs will reach $4.013 trillion worldwide in 2025, as compared to $1.2 trillion in 2020. The payment facilitator market generated $2B in transaction revenue in 2018 and is projected to reach $15B by 2025.

Transaction Volume

Conservative projections estimate that by 2025, the number of PayFacs will have increased over 91% since 2020

Gross Payment Volume

According to eMarketer, gross payment volume processed by PayFacs will reach $4.013 trillion worldwide in 2025, as compared to $1.2 trillion in 2020.

Payment Revenue by 2025

The payment facilitator market generated $2B in transaction revenue in 2018 and is projected to reach $15B by 2025.

PayFac Benefits For Merchants

In addition to streamlining the enrollment and onboarding process, PayFacs typically offer a number of additional payment processing benefits to merchants.

Embedded Payment Processing

Merchants gain almost instant access to payment processing tools that are built into the software they already use. Typically, ISVs or SaaS businesses offer their solutions as either an all-in-one package or a tiered subscription service so that the merchant can subscribe to the features they need.

Less Expensive

A PayFac provides an all-in-one solution that is charged on a month-to-month, annual, or other regular interval that eliminates the need to make a large up- front investment.

PCI Compliance

PayFac solutions are typically fully PCI compliant, so it’s easier for the merchant to maintain compliance with PCI standards.

Improved Business Management

Most PayFacs come equipped with products to support various back-office activities such as invoicing and billing, inventory management, and purchasing software.

PayFac Benefits for ISVs, VARs, and Developers

A PayFac model is best suited for SaaS providers and ISVs whose clients would benefit from integrated payment processing tools. The benefits of becoming a PayFac for these businesses are listed below.

Earnings

The main benefit of becoming a PayFac is recurring revenue. PayFacs earn a percentage of merchants’ transactions through processing fees. With an extra stream of revenue, PayFacs can positively impact the bottom line and improve valuation. And since the PayFac owns the payment processing infrastructure, they have the potential to earn more revenue versus what is standard with an ISO.

Fast Onboarding

PayFacs have the ability to set up merchants very quickly, which allows merchants to skip the lengthy merchant account application process and start taking payments almost immediately. By offering a faster onboarding process, PayFacs can onboard more merchants, increasing revenues.

Control Over End-User Experience

A PayFac has considerable control over its merchants’ customer experience, including transaction processing, streamlined billing processes, and chargeback management. Since PayFacs are typically experts in certain industry verticals, they possess a superior understanding of the unique processing needs of those industries. By making it easier for their merchants to do business, PayFacs can strengthen their client relationships and improve retention.

Flat-Rate Fee Structure

Compared to the fluctuating nature of interchange-plus rates charged by ISOs, having a transparent, easy-to-understand, flat-rate fee structure encourages businesses to sign up with a PayFac because it gives merchants the ability to easily manage their budgets.

The Challenges of the PayFac Model

The PayFac model can be incredibly rewarding for ISVs, SaaS businesses, and VARs, but it does have its drawbacks—particularly if you choose to build your payment facilitator system from the ground up. However, as we will discuss further on, there are alternative PayFac that allow ISVs to bypass many of the challenges listed below.

Financial Risk

One of the biggest disadvantages of the payment facilitator model is the financial risk. A PayFac is liable for all financial risks associated with its merchant portfolio, including loss from fraud, failed payments, and even merchants going out of business. Another factor to consider is merchant profitability. Very small businesses that process only a few transactions per month are typically not ideal clients because there isn’t enough volume to generate significant profits.The cost of acquiring, onboarding, and supporting low-volume businesses can be more than the money earned from processing and transaction fees.

Overhead and Operating Costs

Along with financial risk, the costs associated with becoming a payment facilitator can be considerable. Developing payment infrastructure, processes, and software from the ground up can cost hundreds of thousands of dollars, if not millions. The business must be able to pay for back-office support services and meet PCI DSS compliance audit criteria. Additionally, payment facilitators must consider the staffing costs of payment experts, lawyers, and other specialists, as well as the costs for required licenses, certifications, business taxes, registration, and card brand renewal fees—all of which can add up quickly.

Time-to-Market

Building a payment infrastructure from scratch takes time. After making an initial investment, it can take years for a payment facilitator to generate a profit. PayFacs not only have to piece together the technology but also form relationships with processors, acquiring banks, and other key players. Additionally, designing and implementing processes, hiring payment, legal, and other specialists, and developing risk management policies are all very time consuming in terms of the start-up period and managing ongoing operations.

PayFac Alternative: PayFac-as-a-Service

Fortunately, there is a quicker and less complicated path to becoming a payment facilitator, which also mitigates many of the risks and costs mentioned above. With the growth of off-the-shelf PayFac offerings known as PayFac-as-a-Service (PFaaS) solutions, ISVs or VARs can get up-and-running fast with fewer overhead costs.

PFaaS products are out-of-box solutions that equip businesses with everything they need to become PayFacs: software, compliance, risk monitoring, and so much more—without shouldering the initial investments of capital and time. With a PFaaS solution, ISVs can board merchants quickly and control the customer experience. These solutions require less risk than that of a full-fledged payment facilitator and significantly reduce upfront costs. And the best part is, ISVs and SaaS businesses can typically earn a return in much less time.

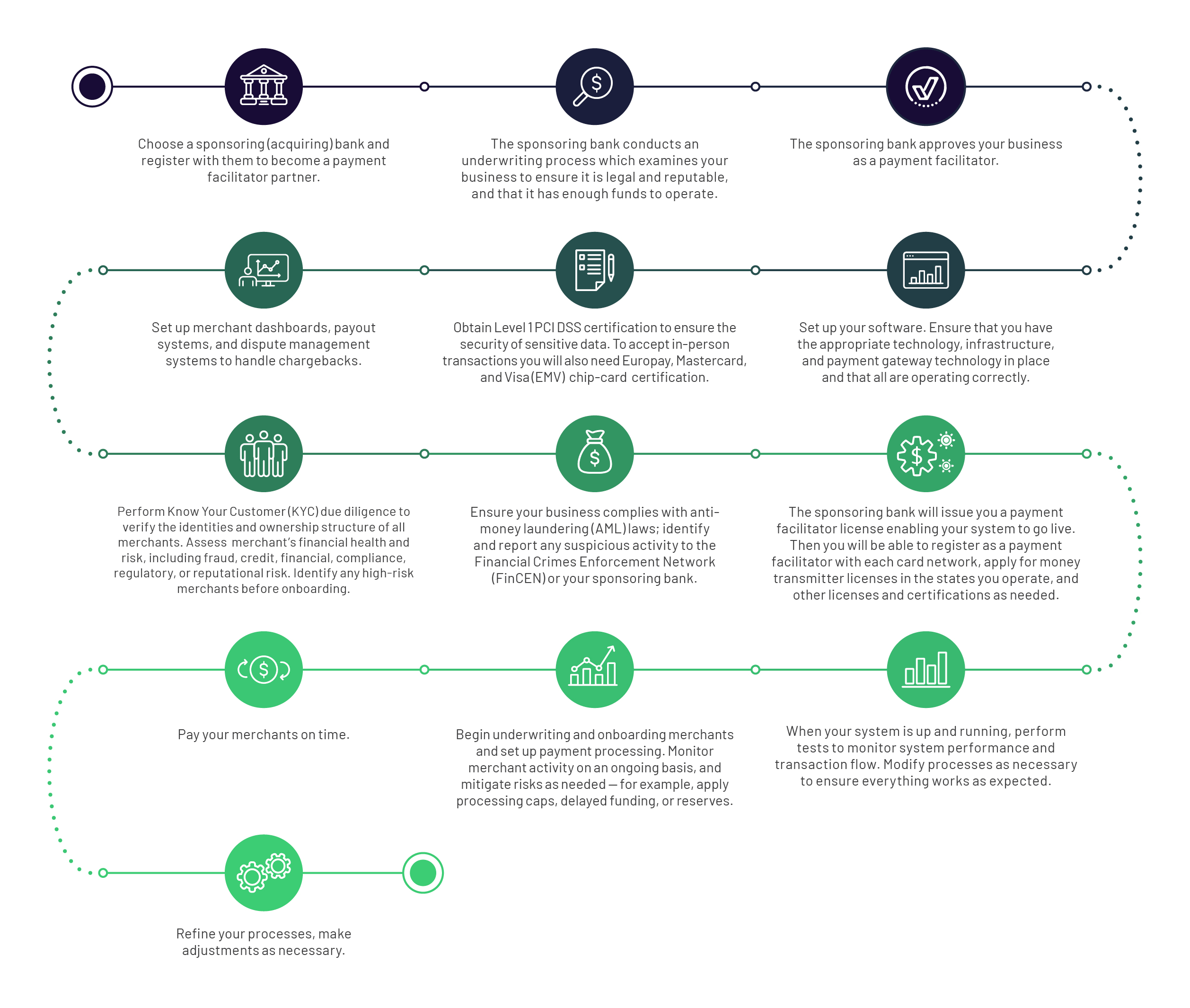

Getting Started as a Traditional Payment Facilitator

You’ve researched your industry verticals, analyzed costs and profit potential, and now understand the financial risks and responsibilities you will be taking on. If you decide that becoming a payment facilitator is right for your business, here’s an overview of how the traditional process works and what you should be prepared to do.

Taking the PayFac Plunge

Whether you decide to build your own payment facilitator infrastructure or utilize an off-the-shelf PFaaS solution, the upside for ISVs and SaaS businesses

is clear. Are you ready to enjoy the benefits of the payment facilitator model?

- Greater control over your clients’ end-to-end user experience

- Rapid and hassle-free account onboarding

- Simple and transparent flat-rate fee structures

- Reliable and lucrative revenue stream

- Access to seamless integrations and cutting-edge technology

Becoming a payment facilitator will require varying levels of time and effort depending on the option you choose. But, integrating with the right payment technology makes it easy to grow your business and watch your profits soar. Learn why developers choose to integrate with Cardknox. Visit cardknox.com/cardknox-go today.

Read the full white paper anytime and anywhere.