The Payments Industry Landscape: What Does It Look Like Today?

The payments industry is a rapidly changing scene that is constantly in flux due to the introduction of new payment methods, mergers and acquisitions, and technology. Especially as technology advances, we’re seeing payment technology companies play a bigger role in the payments industry—and many of them are even merging with traditional financial institutions to cater to the latest customer and merchant preferences. Unlike in the past, when payment processing was simply about facilitating the transfer of funds, the newest players in the payment processing world are completely redefining the customer experience and enabling business owners to manage their businesses with incredible ease.

Read the full white paper anytime and anywhere.

In this white paper, we’ll give a high-level overview of today’s payments landscape: how the payment processing system works, who the major players are, and what the latest technology looks like. Plus, we’ll touch upon some trends in consumer behavior that are likely to impact the future of the industry.

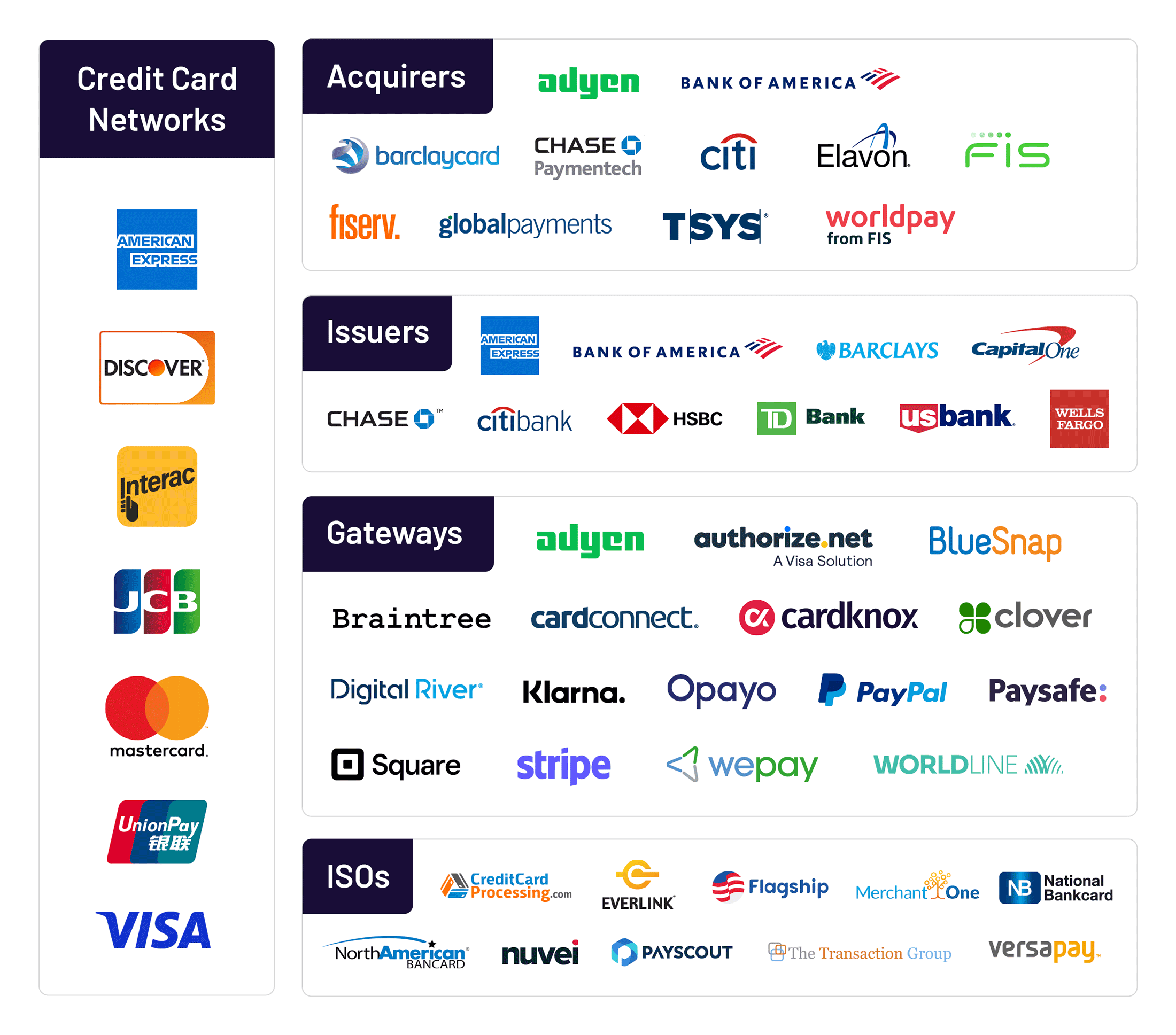

The Payments Ecosystem

The payments ecosystem is made up of a combination of players that interact with each other during the payment transaction process—such as issuers and acquirers, credit card networks, payment processors, payment gateways, independent sales organizations, value- added resellers, and payment facilitators. All of these entities play specific roles in the payment processing cycle. The following illustration shows some examples of these players.

The Payment Processing Cycle

The payment processing cycle is complex and has a lot of moving parts. When a customer swipes their credit or debit card at a payment terminal, the transaction typically takes only a few seconds—but the process itself entails multiple steps and involves several entities that interact with each other. For example, there are companies that work with the other players to process and facilitate transactions, payment processors that provide services to merchants and may facilitate moving money between banks, banks that service merchant accounts and perform the settlement process, and banks that issue credit cards to consumers.

Here’s a flowchart of the standard payment processing cycle:

Now, let’s take a closer look at what actually happens behind the scenes in order to facilitate the transfer of funds — in particular, for credit card payments. The transaction process consists of two major steps: authorization and settlement

The Authorization Process

- The customer purchases goods or services from the merchant and swipes their credit or debit card through a point-of-sale (POS) terminal or device that captures the customer’s card information.

- The customer’s card information is transmitted to the merchant’s payment processor, who in turn passes the card information and transaction amount to the merchant’s bank (the acquirer, or acquiring bank). Note that some payment processors are also acquiring banks.

- The acquiring bank captures the transaction and forwards the information to the customer’s credit card network (e.g. Visa, Mastercard).

- The credit card network then routes the transaction to the cardholder’s bank (the issuer, or issuing bank), and requests an approval. The transaction is approved or declined depending on the availability of funds and the status of the cardholder’s account. This approval process is known as authorization.

- The issuing bank sends the response back to the credit card network. If the authorization was approved, the issuing bank assigns and transmits an authorization code along with its response, and a hold is placed on the cardholder’s funds.

- The credit card network sends the approval to the merchant’s payment processor, who in turn sends the approval to the acquiring bank.

- The acquiring bank routes the approval code or response to the merchant’s terminal. Depending on the merchant or transaction type, the merchant’s terminal may print a receipt for the customer to sign.

The Settlement Process

- At the end of each day, the merchant closes out the day’s sales and transmits the information to their payment processor, who in turn transmits the information to the acquiring bank. This step, in which the merchant initiates the transfer of funds to their account, is known as capture.

- The acquiring bank routes all transaction information to the credit card network for settlement, who in turn passes on all approved transactions to the cardholder’s issuing bank.

- The issuing bank transfers the funds to the merchant’s acquiring bank, minus the interchange fee.

- The acquiring bank then deposits the amount, less the merchant discount fee, to the merchant’s bank account.

- The issuing bank bills the cardholder for the transaction.

Understanding the Payments Industry’s Key Players

Here’s an overview of various groups and how they each function within the payments ecosystem:

Issuers

Issuers are banks or other financial institutions that issue credit cards to consumers on behalf of the card networks. Specifically, these are the bank names that appear on credit cards, such as Chase or Bank of America. They also issue payment to the merchant’s bank (the acquiring bank) on behalf of their customers, which means they assume risk in the event that the customer is unable to pay their credit card balance.

Acquirers

An acquirer is a bank or financial institution that enables a merchant to accept credit card payments from a customer’s card-issuing bank within a credit card network. These are typically referred to as merchant acquirers. An acquirer primarily processes credit or debit card payments on behalf of a merchant, but they can also be either a payment processor or an Independent Sales Organization (ISO)—Elavon is one such example of an acquiring bank that’s also a payment processor. The acquirer assumes the risk and passes the merchant’s transaction information on to the card brand associations (the card networks), and the issuers, to complete the payment.

Credit Card Networks

Card networks such as Visa, Mastercard, American Express, and Discover facilitate transactions among consumers, merchants, processors, and banks. They oversee payment processing activity, monitor settlement and the process of clearing sales, and regulate and manage their card network’s compliance policies.

These companies provide the electronic networks which allow all the players to communicate and process transactions, and they charge fees to the issuing and acquiring financial institutions. American Express and Discover operate a little differently than Visa and Mastercard by issuing their own credit cards (rather than an issuing bank), and they consolidate the functions normally provided by the merchant bank, card issuer, and card network.

Payment Processors

Payment, or credit card, processors are companies that work in the background to provide payment processing services to merchants. Their responsibilities include establishing merchant accounts; accepting and processing credit, debit, and prepaid card payments; managing credit and debit card processing; and implementing certain anti-fraud measures. Processors may be associated with acquiring banks, like Bank of America, or they can be independent from a bank, like Fiserv.

Payment Gateways

A payment gateway is a software application that enables merchants to accept payments and transmits payment data for processing. The payment gateway securely encrypts payment information and transfers that data between the merchant’s store or website, the bank that processes the payment, and the bank that issued the card used to make the purchase.

One of the most important aspects of a payment gateway is that it has robust security standards in place to keep cardholder data safe during the transmission process. When a customer uses their payment card, the payment gateway securely sends the customer’s card information to the payment processor. Some gateways, like Cardknox, also provide merchants with a broader range of payment processing features and benefits.

Merchant Services Providers

Merchant services providers enable merchants to process payments by setting up and overseeing merchant processing accounts, and managing the front-end of customer transactions—such as all the hardware and software needed to facilitate payments. There are various types of merchant services providers, with Independent Sales Organizations and Payment Facilitators among the most common.

Independent Sales Organizations (ISOs)

Independent Sales Organizations (ISOs) are a type of merchant services provider. They sell credit card processing services to merchants, and they act as intermediaries between merchants, payment processors, and acquiring banks. In some cases, they might actually be banks; for example, Wells Fargo is a Fiserv ISO.

ISOs service merchant bank accounts and, at times, create the relationship between a merchant and bank in the first place. ISOs also lease point-of- sale terminals to merchants and may service customers who have problems with their cards. Because an ISO is not a bank, it does not physically manage merchants’ money and it’s also not regulated in the same way.

Payment Facilitators (PayFacs)

The traditional payment processing model is beginning to change with the rapidly rising popularity of payment facilitators. Like ISOs, PayFacs are merchant services providers that enable merchants to accept payments. However, PayFacs offer several unique benefits that are not as prevalent with ISOs. For example, a PayFac’s merchant customers benefit from fast and seamless account onboarding, simple flat rates, and advanced technology.

Another distinction of the PayFac model is that it allows Independent Software Vendors (ISVs) and Software-as-a-Service (SaaS) providers to become merchant services providers and embed payments within their software. As a result, they enjoy maximum control over the customer experience while earning a portion of payment processing fees.

There are various options for ISVs and SaaS businesses who choose to become PayFacs. These options offer varying levels of risk and investment. For example, to simplify the PayFac journey for ISVs and other merchant-facing businesses, integrated payment solution providers have begun to offer the PayFac-as-a-Service (PFaaS) model. PFaaS products are out-of-box solutions that equip businesses with everything they need to become PayFacs: software, compliance, risk monitoring, and so much more. ISVs that utilize PFaaS solutions realize the benefits of revenue sharing, improved user experiences, and reduced risk—without shouldering the initial investments of capital and time.

Who the Industry Players Are

Here’s a rundown of some of the largest, most well-known payment providers in the industry:

Founded in 1996, Fidelity Payment Services is one of the most respected names in payment processing and merchant services, equipping merchants with all the tools, systems, and support they need to process payments. Together with Fidelity’s in-house payment technology platform, Cardknox, the company processes billions of dollars in transactions annually for merchants in the U.S. & Canada.

Cardknox is the leading developer-friendly payment technology provider for in-person, online, and mobile transactions. Cardknox is a subsidiary of Fidelity Payment Services and it serves thousands of customers across every major industry throughout the U.S., the U.K., and Canada.

Citigroup processes transactions in more than 100 currencies. It offers end-to-end processing services, such as pricing, transactions, reporting, customer service, and billing.

Stripe, Inc. is an Irish-American financial services and software as a service (SaaS) company that primarily offers payment processing software and application programming interfaces (APIs) for e-commerce websites and mobile applications.

Wells Fargo is ranked 37th on the Fortune 500 list of the largest companies in the U.S., and is one of the “Big Four Banks” of the United States. The bank offers payment processing for businesses across all sales channels with next-day funding available.

Bank of America Merchant Services has the advantage of functioning within the second-largest bank in the U.S. The service promises acceptance of all kinds of payments (credit cards, debit cards, electronic checks, and gift cards), access to funds on the next business day, and mobile support.

Fiserv provides financial institutions in over 100 countries with services like payment processing, risk assessment, and mitigation. In 2019, Fiserv acquired First Data for $22 billion to expand its suite of services and enhance its value proposition.

Chase for Business is the merchant services subsidiary of JPMorgan Chase Bank, the largest bank in the U.S. The company, formerly known first as Chase Paymentech and then Chase Merchant Services, is one of the largest processors in the United States, processing over $1 trillion annually. It functions as an acquiring bank, able to establish merchant relationships and process transactions.

TSYS is the third-biggest payment processor in the U.S. credit card issuer market. It provides services to over 3.5 million small- and medium- sized businesses (SMB) merchant locations and more than 1,300 financial institutions (FIs) across more than 100 countries. In 2019, the processing company was acquired by Global Payments for $21.5 billion, and the two companies expect at least $300 million of annual run-rate cost synergies.

Elavon is the fourth-largest merchant acquirer in Europe,and it’s the seventh largest in the U.S. Formerly known as NOVA, the payment solution provider is a subsidiary of US Bancorp and offers features like processing online and in-store payments. In 2019, Elavon acquired the payment gateway Sage Pay to help grow its market share in the U.K. and Ireland. Elavon processes payments in more than 30 countries for more than one million merchants.

Founded in 2009, Square is a merchant services and mobile payment technology provider that equips over 30 million businesses with the tools they need to accept credit card payments.

Worldpay, formerly Vantiv, is a provider of payment and technology services to merchants and financial institutions in the U.S. Prior to its acquisition by FIS in 2019, Worldpay was the largest U.S. merchant acquirer in terms of its transaction volume.

Adyen is a full-stack payment gateway, providing e-commerce companies with a payment platform that includes a gateway, risk management, and front-end processing services. In 2019, Adyen announced the launch of Adyen Issuing—a product that builds onto in- store and online processing and gateway functionality.

Heartland, now a Global Payments company, is a provider of card-based payment processing services to merchants in the United States.

Fidelity Information Services (FIS) is a leading financial services technology provider that services the capital markets, retail banking, and merchant industries. In 2019, FIS acquired Worldpay, a global leader in e-commerce and payments, which greatly expanded FIS’s products and services as well as its distribution reach.

Global Payments is a worldwide provider of payment technology and software solutions. Its services include credit/debit/purchasing cards, electronic check conversion, money transfer, verification and recovery services, gift/loyalty cards, check guarantee, ACH checks, financial EDI services, and point-of-sale equipment. In 2016, Global Payments acquired Heartland, a top U.S.-based payment processing and technology provider.

The Changing Payments Landscape: Industry Trends

Looking ahead, here are several key trends that are on track to reshape the payment processing ecosystem.

New Fintech Players

The giants of technology have moved into the payments industry. Traditional players and banks are merging with technology companies to get even closer to their customers. For example, in 2019, U.S. Bank acquired the Talech POS system because it wanted to get a foot in the door with technology, and Apple has partnered with Goldman Sachs for the Apple credit card. Beginning in 2020, Amazon also started testing the payment waters with small business loans underwritten by Goldman’s Marcus brand.

Consumers favor this combination of big tech and banking because it saves them time and money while providing a sense of control over their finances. This growing appeal puts tech companies like Apple, Amazon, and others in a position to meet the demand that traditional finance entities may not be able to achieve on their own.

Due to the fusion of big tech and banking, fintech is now said to have reached “mass adoption.” A recent survey from Plaid found that the percentage of U.S. consumers using fintech rose to 88% in 2021, compared with only 58% in 2020—meaning that more Americans now use fintech than they do video-streaming subscriptions (78%) and social media (72%), according to the report.

Contactless Payment Adoption Increases

As the global pandemic unfolded, consumers became acutely aware of heightened health risks at checkout. As a result, contactless payments have been on the rise. However, in addition to avoiding physical contact, the benefits of speed and convenience will continue to appeal to shoppers even as the pandemic winds down. In a 2020 Mastercard global consumer study, nearly eight in 10 consumers say they use contactless payments. This trend appears to be here to stay as approximately 74% state they will continue to use contactless post-pandemic.

Amazingly, the speed at which a card reader connects with a contactless card or phone is less than one- tenth of a second. The technology supporting this capability is called near-field communication (NFC), a short-range wireless connectivity technology. In the case of contactless payments, phones and cards with embedded NFC chips share data with NFC-equipped reader devices.

Another benefit of contactless payments is enhanced security. NFC chips are based on the same technology as their technological predecessor—the EMV chip. In the mid-1990s, credit card companies began adding EMV chips to credit and debit cards to help reduce fraudulent transactions associated with magnetic stripe cards. Unlike magnetic cards, the data that EMV chips store is encrypted, making it harder for thieves to steal information. Additionally, the complexity of EMV chips makes them difficult to counterfeit.

Digital Wallets on the Rise

As the adoption of mobile devices has grown over the past few years, so has the number of consumers using digital wallet apps on their smartphones to make purchases. Although the term is often used interchangeably with mobile wallets, the two are slightly different. While both digital wallets and mobile wallets store payment information, a mobile wallet is a payment app used to make in-store purchases from a mobile device—examples include Walmart Pay, Google Pay, and Apple Pay. “Digital wallet” is an overarching term that includes mobile wallets, but digital wallets can also make online purchases, transfer funds between friends and family, and store other types of data, including gift cards, loyalty cards, and ID cards. Popular digital wallets include the previously mentioned mobile wallet apps as well as apps like PayPal, Zelle, Samsung Pay, and many others.

Digital wallet usage is most prevalent in younger generations, though older generations are not far behind. According to a study by Nerdwallet, 94% of millennials use digital wallets compared to 87% of Gen Zers, 88% of Gen Xers, and 65% of baby boomers. Interestingly, among those who already use digital wallets, 53% use them primarily to pay for online purchases through retailers. Paying back friends or family members was the second most common reason at 43%, followed by paying bills at 40%.

Digital wallets make it quick and easy to pay. They also don’t require a physical credit card for in-person transactions and they eliminate the process of keying in digits when shopping online. And in the case of peer-to-peer apps (P2P) such as Venmo or CashApp, two parties can complete a transaction almost instantaneously without the need to provide account details—all that’s needed is a name, email, or phone number.

With this level of convenience, it’s no wonder digital wallet adoption is on the rise. A study published on Bloomberg’s website estimates that more than half of the world’s population will use mobile wallets by 2025. eMarketer predicts that the number of P2P users will increase by 21% from 2022 to 2026, and it is estimated that 70% of smartphone users will use P2P apps by 2026.

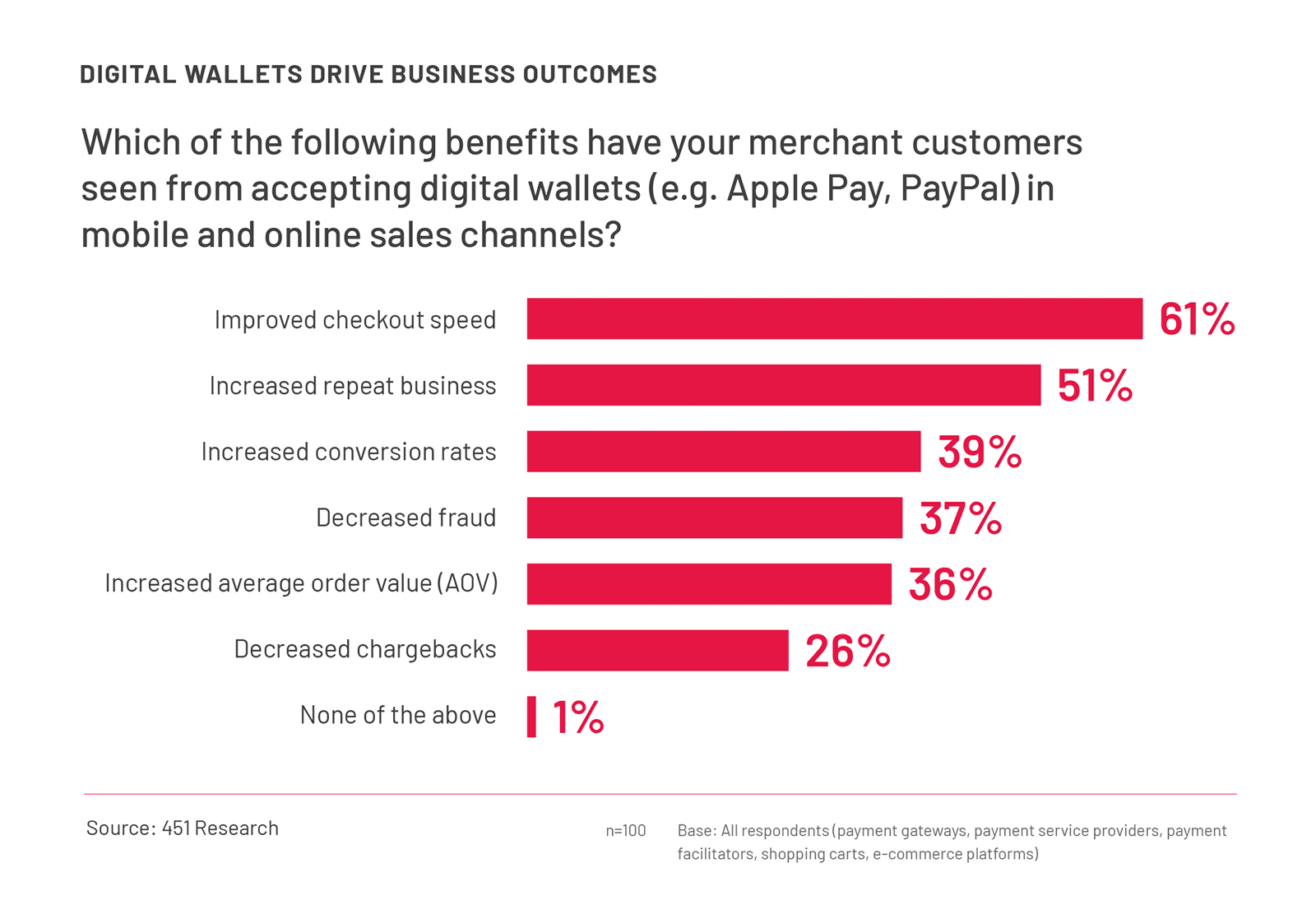

As consumers gravitate toward digital wallets, merchants are noticing the benefits as well. Offering digital wallet options at checkout reduces friction and can translate to business results that directly impact the bottom line. A 2019 survey by 451 Research revealed that more than three in five digital commerce enablers said digital wallet acceptance was helping their merchants improve checkout speed, and over half said wallets were driving up customer visit frequency (see graph below). Thirty-nine percent of digital commerce enablers noted increased conversions as a benefit, while thirty-six percent said digital wallets help increase order values.

Mainstream Use of Cryptocurrency

The growing popularity of cryptocurrencies has driven many merchants to accept these block chain-based currencies. Though crypto may have its beginnings as a peer-to-peer payment tool and a non-traditional investment, this new form of digital money is becoming a part of the financial mainstream. A PYMNTS survey revealed that 46 million U.S. consumers would consider paying for retail purchases using cryptocurrencies. Provided this interest keeps growing, crypto wallet options at checkout will soon become prevalent—especially as consumers continue to prefer fast and convenient payment methods. Similar to other digital wallets, crypto wallets allow consumers to check out with just a few clicks, making them a frictionless solution that can boost merchant sales.

Growth of ACH Transactions

In addition to credit and debit card transactions and peer-to-peer (P2P) payments, Automated Clearing House (ACH) transactions are on the rise as consumers and businesses around the globe embrace mobile and digital forms of payment over cash. Notably, the total digital transaction value is expected to show a compound annual growth rate (CAGR) of 13.10%, resulting in a projected total amount of $13.91 trillion by 2026.

Consumers now expect the convenience and immediacy of cash when using digital payment methods, while merchants appreciate enhanced cash flow management. This need for speed is a key reason why the ACH Network experienced record payment volume growth in 2020 at a time when the pandemic accelerated the nation’s shift to electronic payments. Adoption of same-day ACH also soared, with payment volume rising 39%.

Real-Time Payments

Real-time payments are taking the speed of standard ACH payments a step further, offering instant fund disbursement and settlement. Real-time payments in the United States are exploding, with significant year- over-year growth of 69%—while 40 countries around the globe have real-time payment processing solutions in place. The U.S. currently has one real-time payment system, known as RTP® (Real-Time Payments), and another, FedNowSM, will launch in 2023.

The RTP network, launched by The Clearing House in 2017, is a payments system that all federally insured depository institutions can use to clear and settle payments in real-time. Its network serves as a platform that allows banks and other financial institutions to create and deliver innovative products and services to their customers. RTP technology was designed to facilitate payments across all payment categories, including business-to-business (B2B), business-to-consumer (B2C), consumer-to-business (C2B), peer-to-peer (P2P), government-to-citizen (G2C), and account-to-account (A2A) transactions.

FedNow is a real-time payment and settlement service for individuals and businesses that the Federal Reserve Bank is currently developing. The service will incorporate clearing functionality into the process of settling payments. This functionality enables banks and financial institutions to exchange the debit and credit information needed to process payments and notify customers whether the payments were successful.

New Hardware and Retail Solutions

The switch to advanced technologies and new payment methods has also contributed to changes in the payment landscape, requiring retailers to upgrade their hardware and software. For example, the introduction of EMV chip technology and its benefit of increased security pushed merchants to update their point-of-sale equipment. Adding Near Field Communication (NFC) technology to chip cards and mobile devices also created an opportunity for hardware providers to introduce contactless point- of-sale terminals. Today, nearly all POS terminals support EMV technology, and many have contactless capabilities built in. Most major retailers, such as CVS pharmacies and Target stores, can accept contactless payments.

The unattended retail industry has also made significant strides in recent years as part of the move toward contactless payments—resulting in more advanced terminals and the software needed to support them. Broadly defined, the unattended retail industry refers to automated systems such as kiosks and vending machines that are deployed to help in-store buyers shop, order, and transact without any intervention from employees or staff. As a whole, the U.S. self-service systems market is anticipated to reach $2.97 billion by 2028, expanding at a compound annual growth rate of 11.3% from 2021 to 2028.

The mobile-point-of-sale (mPOS) trend is also poised to greatly impact the payments hardware and software industries. mPOS untethers traditional POS solutions from fixed stations, allowing employees to collect payments via mobile devices like tablets and smartphones paired with a card reader—often with no physical contact. As consumers discover how fast and convenient mobile payments are for in-person purchases, savvy merchants are responding by offering more options. Statista projects mPOS transaction values to show an annual growth rate of 15.47%, while mPOS will account for 24.2% of user transactions in 2025.

Additionally, a growing number of industry players like MagicCube and Apple are rolling out new tap to phone mPOS software solutions that eliminate the need for extra hardware purchases. Similar to how customers use their mobile wallets or NFC chip cards by tapping their phone or card against a terminal, with tap to phone, customers tap their card against the merchant’s mobile smartphone or tablet. Essentially, the mobile device becomes a mobile-point-of-sale terminal upon installation of a tap-to-phone software app.

Fiserv, Samsung, and Visa recently partnered to create an mPOS solution that successfully accepts a PIN-based contactless transaction on a mobile device. The move to mPOS will continue to put pressure on hardware providers that compete directly against mPOS devices, as well as ISOs that sell legacy devices to merchants.

Security Advancements

As more and more consumers embrace digital payment methods, the need for secure payment processing is taking center stage. As a result, several advanced payment security solutions have been launched in recent years. One such solution is 3-D Secure 2.0, a security protocol that adds a layer of protection to card-not-present (CNP) transactions by authenticating the customer’s identity in real-time. It supports a wide range of e-commerce, in-app, mobile wallets, and MOTO (mail order telephone order) payments.

Advances in biometric technology are also changing the way consumers view payment processing security issues. Market research studies show that consumers believe biometric screening methods, such as fingerprint scanners and voice and facial recognition systems, are easier to use and more secure than other identity verification methods.

Another e-commerce security protocol gaining popularity with merchants is Secure Remote Commerce (SRC), developed by EMVCo. This technology is the framework behind the new digital wallet solution known as Click to Pay, which is supported by American Express, Discover, Mastercard, and Visa. With a single Click to Pay account, a customer can store payment information for all of their credit and debit cards that were issued by these four card brands. Click to Pay uses robust tokenization to replace card data and protect cardholder information. It is designed to be used with a variety of checkout environments and devices such as laptops, tablets, PCs, and mobile devices, giving shoppers increased flexibility plus a quick and easy checkout.

As payment processing technology continues to improve, expect to see more innovative and user-friendly security solutions in the future.

The Growing Popularity of the Internet of Things

The Internet of Things (IoT) is described as physical objects that have the capability to process and exchange data with one another over the internet or another communication network. As these technologies advance, the ability to purchase and process payments has become a notable feature. Devices that now offer purchasing capability include smartphones, smart speakers, smartwatches, and other wearables such as wristbands and even jewelry.

As part of the Internet of Things (IoT), smart speakers have become increasingly popular as home automation systems have expanded. Devices like Google Home, Amazon’s Echo and Alexa devices, and Apple HomePod let a person speak commands, such as asking for weather information or placing an order. The total worldwide transaction value of e-commerce purchases made through voice assistants is expected to rise from 4.6 billion U.S. dollars in 2021 to 19.4 billion U.S. dollars in 2023. This increase equates to more than 400 percent growth in just two years, caused by the increasing opportunities for voice assistants to purchase items, especially through smartphones and smart devices in the home.

Conclusion

Despite its complexities and diverse array of institutions and technologies, the payment industry is truly a cohesive landscape that’s at the forefront of innovation. And increasingly, the industry’s ability to spearhead cutting-edge solutions is driving continued investments and a growing number of mergers and acquisitions.

Even as new technologies and acquisitions disrupt the payment landscape, one thing’s for certain: the industry will continue to do all that it can to make the payment processing cycle as seamless as possible.

Read the full white paper anytime and anywhere.